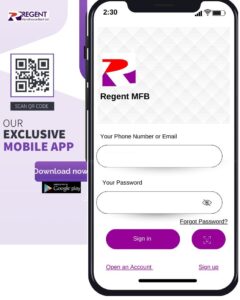

Regent MFB’s mobile banking service allows anyone to access account information from a mobile device. It’s just a free download away

What services are available with the mobile app?

You can download Regent MFB’s mobile app to your mobile devices. The app offers all the features of the mobile browser service. You can use the downloadable app to:

- Check your account balances

- Review recent account activity

- Transfer money between accounts

- Airtime Vendin

- Manage and make payments with Online Bill Pay

Downloading The App

Download the app from play store here

Download the app from IOS store here

Install the app by clicking on “Install” when download is complete on your mobile phone

Allow the request to access device location.

Launch the app by clicking on the app icon from the list of installed apps on your mobile phone